fulton county ga sales tax rate 2019

Fulton county ga sales tax rate 2019 Wednesday June 8 2022 Edit. Some cities and local governments in Fulton County collect additional local.

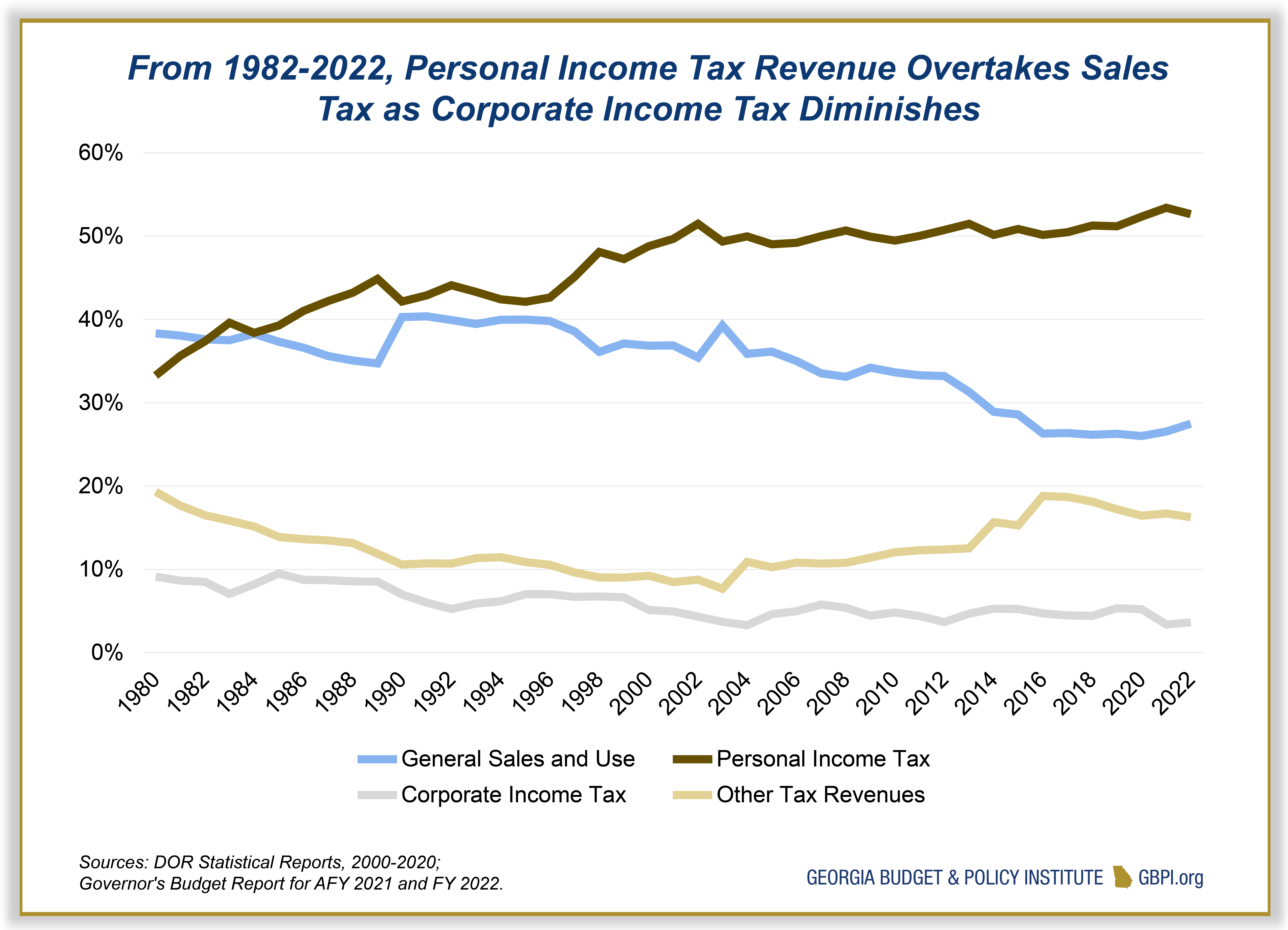

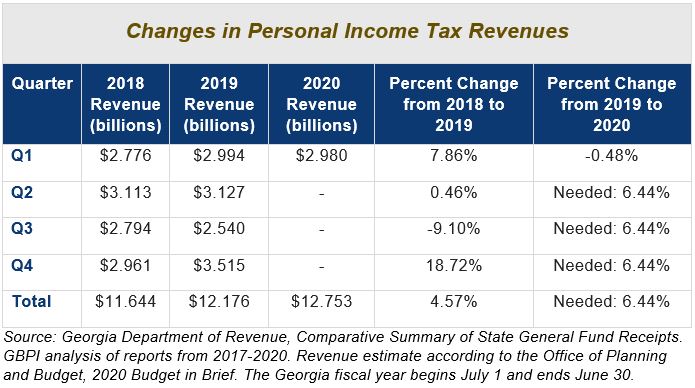

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

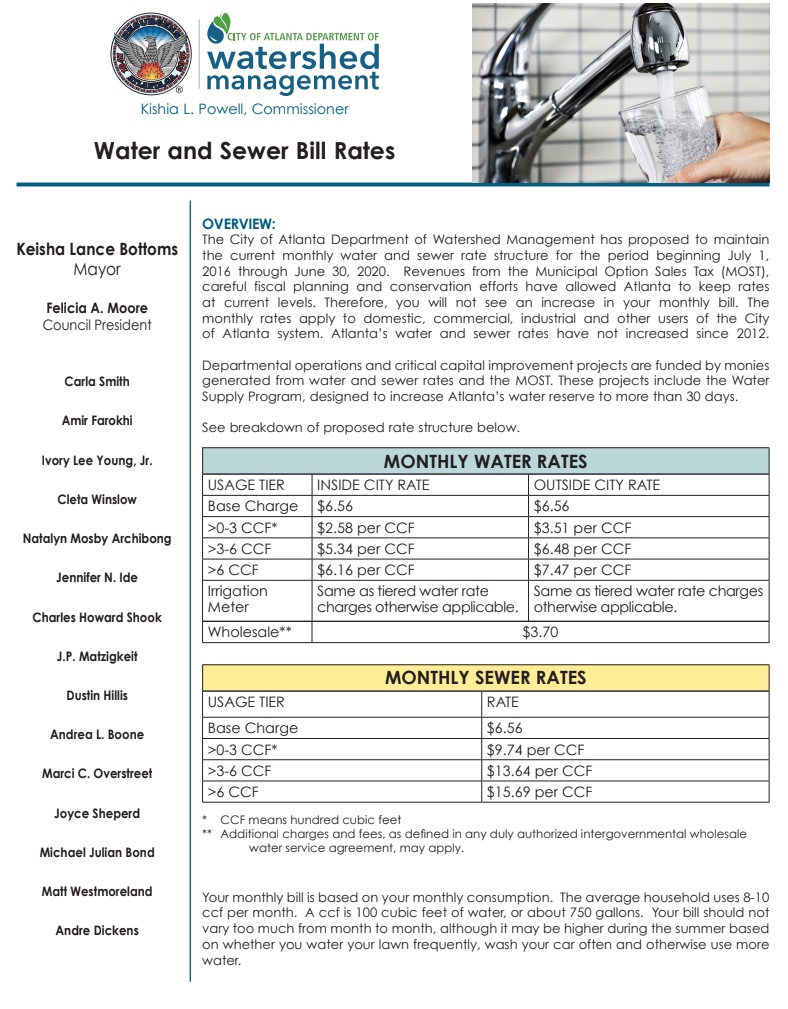

141 Pryor Street SW.

. Surplus Real Estate for Sale. The Fulton County sales tax rate is. A TAX SALE IS THE SALE OF A TAX LIEN BY A GOVERNMENTAL ENTITY FOR UNPAID PROPERTY TAXES BY THE PROPERTYS OWNER.

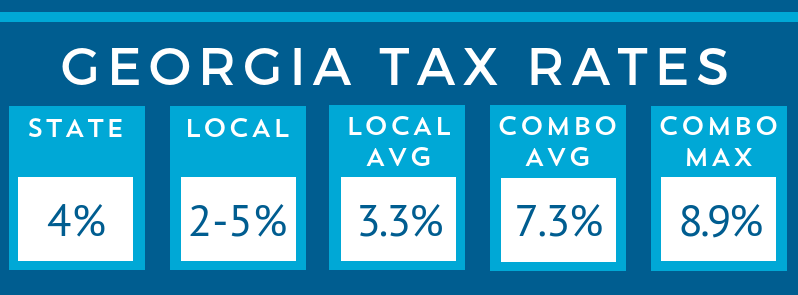

Fulton County plays an important role in creating the right environment to stimulate economic growth and develop an able. Effective January 1 2022 in Fulton County passing vehicle emission inspections are required for 1998 through 2019 model year gasoline-powered cars and light-duty trucks up to 8500 lbs. The 89 sales tax rate in Atlanta consists of 4 Georgia state sales tax 3 Fulton County sales tax 15 Atlanta tax and 04 Special taxThe sales tax jurisdiction name is Atlanta Tsplost Tl.

The Tax Commissioner takes the appraised value and the exemption status provided by the Board of Tax Assessors along with the millage rates set by the Board of Commissioners and other. The 2018 United States Supreme Court decision in South Dakota v. FULTON COUNTY GEORGIA July 2019 FINANCIAL RESULTS Unaudited Cash Basis.

The Georgia state sales tax rate is currently. Effective January 1 2019 Code 000 The. OFfice of the Tax Commissioner.

In the same year the murder rate. The Board of Commissioners and County Manager have categorized County efforts into six strategic areas. The current total local sales tax rate in Fulton County GA is 7750.

Actual sales taxes Actual property taxes Total 2537 Total. 50 Mobile Ave NE Atlanta GA is a multi family home that was built in 1940. Sales tax in fulton county ga 2019 Thursday October 6 2022 Edit.

The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state sales tax and 375 Fulton County local sales taxesThe local sales tax consists of a 300 county sales tax. Fultons rate inside Atlanta is 3. A county-wide sales tax rate of 3 is applicable to localities in Fulton County in addition to the 4 Georgia sales tax.

The minimum combined 2022 sales. The December 2020 total local sales tax rate was also 7750. Fulton County Sheriffs Tax Sales are held on the first.

Georgia S Internet Retail Tax Takes Effect Jan 1

Fulton County Georgia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Save Fulton Cities The Cities Of Fulton County Have United

Fulton County Property Tax Assessments Have Been Issued Here S What You Can Do Next 11alive Com

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Georgia Sales Tax Small Business Guide Truic

How To Perform Line Level Tax Calculation For Sales Orders Dynamics 365 Business Central Forum Community Forum

News Articles Georgia Public Broadcasting

Tangible Personal Property State Tangible Personal Property Taxes

Ga Counterclaim County Fill Out And Sign Printable Pdf Template Signnow

2020 Revenue Collections Fall Short Of State S Estimates Georgia Budget And Policy Institute

What Is The Fulton County Sales Tax The Base Rate In Georgia Is 4

Atlanta Georgia S Sales Tax Rate Is 8 9

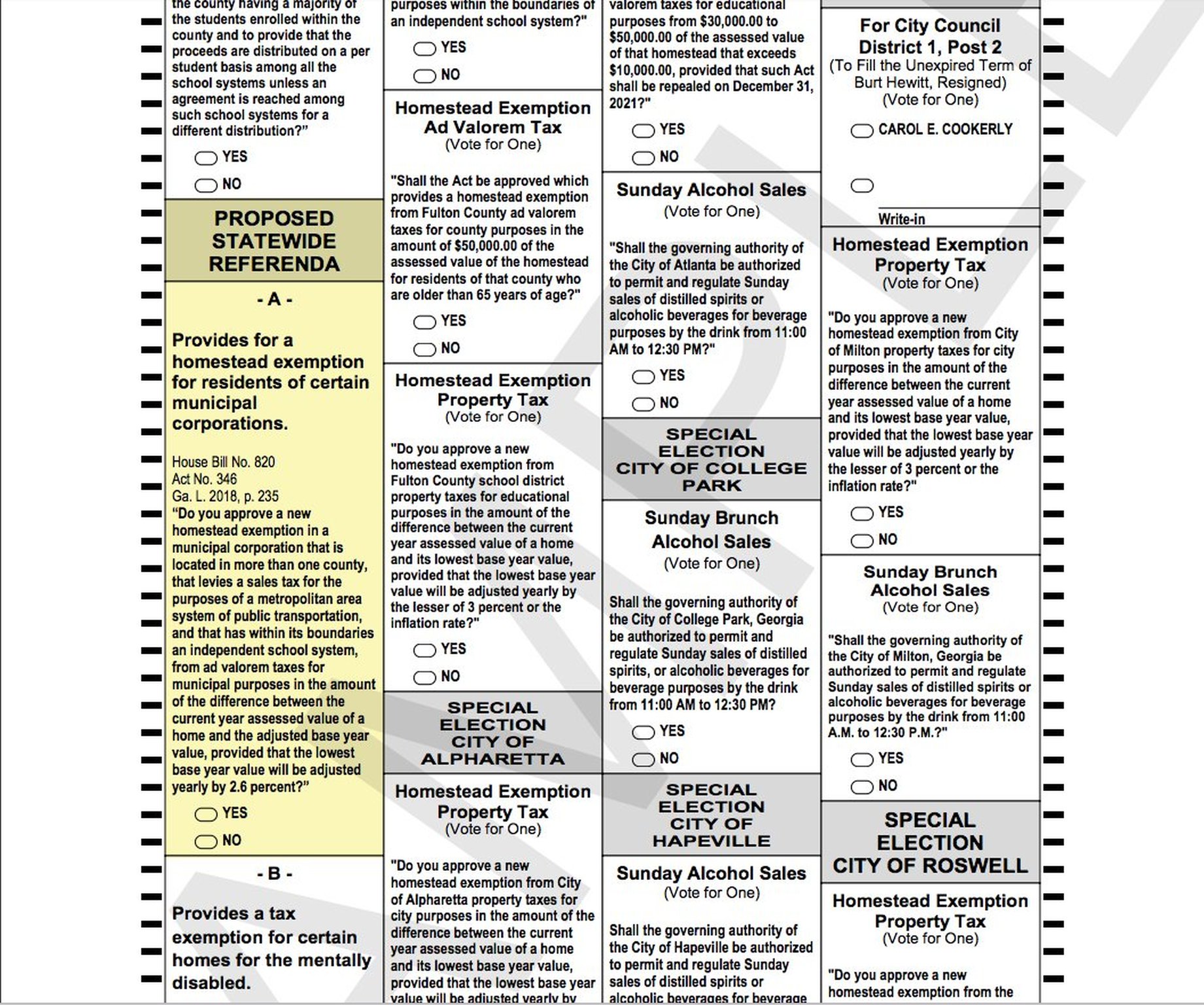

Fulton County Atlanta Tax Proposals On Nov 6 Ballot

Georgia State County City Municipal Tax Rate Table Sales Tax Number Reseller S Permit Online Application

Robb Pitts Chairman Board Of Commissioners Of Fulton County Atlanta Ga